Essence of the Restrictions

As we previously wrote, the eleventh EU sanctions package established, among other things, a requirement for importers of iron and steel products to provide evidence of the place of origin of the products in order to exclude the import into the EU of iron and steel products of Russian origin. The eleventh EU sanctions package, including the Restrictions, was subsequently implemented by Switzerland.The UK has adopted a similar measure. As the UK Government notes, iron and steel processing in third countries can be used to disguise the Russian origin of products, and the new restrictions are therefore aimed at tackling the circumvention of the sanctions.

UK guidance on the Restrictions

The UK Department for International Trade and the Department for Business and Trade have issued joint guidance on the Restrictions (“UK Guidance”). It sets out four different scenarios for importing iron and steel products.Importing into the UK is prohibited

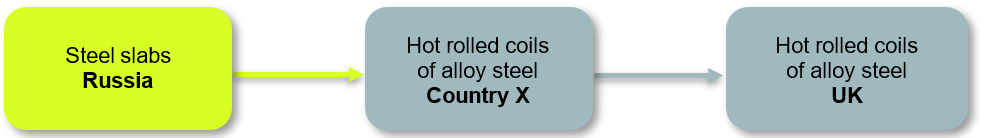

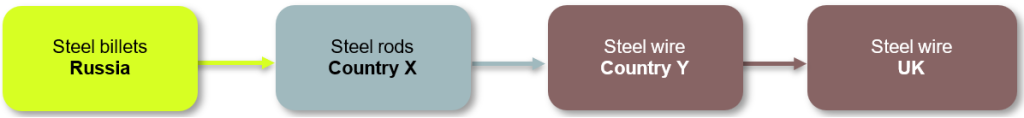

Scenario1. A product of Russian origin that is a good listed in Schedule 3B when it leaves Russia is then processed in a third country into another good listed in Schedule 3B.

Scenario 2. A product of Russian origin that is a good listed in Schedule 3B when it leaves Russia then undergoes multiple stages of processing in one or more third countries, so that it loses its Russian origin before it is incorporated in the final transformation step, but remains a Schedule 3B good.

Importing into the UK is permitted

Scenario 3. A product of Russian origin that is not a good listed in Schedule 3B when it leaves Russia is then processed in a third country, so that it becomes a good listed in Schedule 3B.

Scenario 4. A product of Russian origin that is a good listed in Schedule 3B when it leaves Russia is then processed in a third country into an entirely different product (a good not listed in Schedule 3B).

The UK Guidance also provides guidance on proving origin. Traders should be prepared to have documentation available to demonstrate evidence of a good’s supply chain, including the following information:

- the country of origin of the iron and steel products processed in the third country (or third countries);

- the date that the iron and steel product left its country of origin; and

- the country(ies) and facility(ies) where processing has taken place.

EU and Swiss guidance on the Restrictions

The EU Guidance on the Application of Sanctions against Russia (“EU Guidance”) has also been updated in connection with the entry into force of the Restrictions. The EU also provides three examples of situations which are similar to those set out above in relation to the UK.An important answer concerns whether the Restrictions apply to reusable packaging (e.g., iron and steel containers). The EU notes that the Restrictions apply to goods declared on the customs declaration. At the same time, reusable strong metal packaging regularly used in standard business practice and intended solely for the transportation of goods should not be subject to the Restrictions.

According to the EU Guidance, the Restrictions also apply to the temporary import into the EU of the goods concerned, e.g. for repair, which are re-exported to a third country after repair.

In addition, the EU Guidance answers many questions about proving the place of origin of steel and iron. The main but not the only possible proof, as in the case of the UK, is the Mill Test Certificate.

Switzerland has also published guidance concerning, among other things, the issue of proving the country of origin of steel and iron (“Swiss Guidance”). The Swiss authorities aim to ensure that the application of sanctions is as close as possible to the practice used in the EU. Among the possible evidence listed are Mill Test Certificates, invoices, bills of lading, quality certificates, declarations from long-term suppliers, estimates and production documents, customs documents of the exporting country, trade correspondence and product descriptions.

The Swiss Guidance also notes that no proof is required in the case of the import or transportation of steel products from the EU or the UK, or in the case of the re-import of products that were already in free circulation in Switzerland.